Learning to be Cash Clever!

Learning to be Cash Clever!

August 22, 2019 at 2:23 PM

Learning to be ‘cash clever’ and developing lifelong financial literacy skills from a young age is one of the key elements of the Girls’ School mathematics programme. This year, the Year 5-8 students have taken part in several workshops and exercises that have tested their abilities to budget, save and spend their money wisely.

The Year 6 students were given a $20 budget to create, market and sell a product of their choice to ‘customers’ (other students). In small groups, the students made ‘products’ such as lemonade, hair clips and sweet treats to sell and make a profit. Throughout this process, the students surveyed their customers to find out what they wanted, learned how to budget effectively, compared costs between three different supermarkets, made their product and marketed and sold it. Once they sold their items, they had to count the profit and analyse the figures before donating the total $943 profit to the Vanuatu Service Trip.

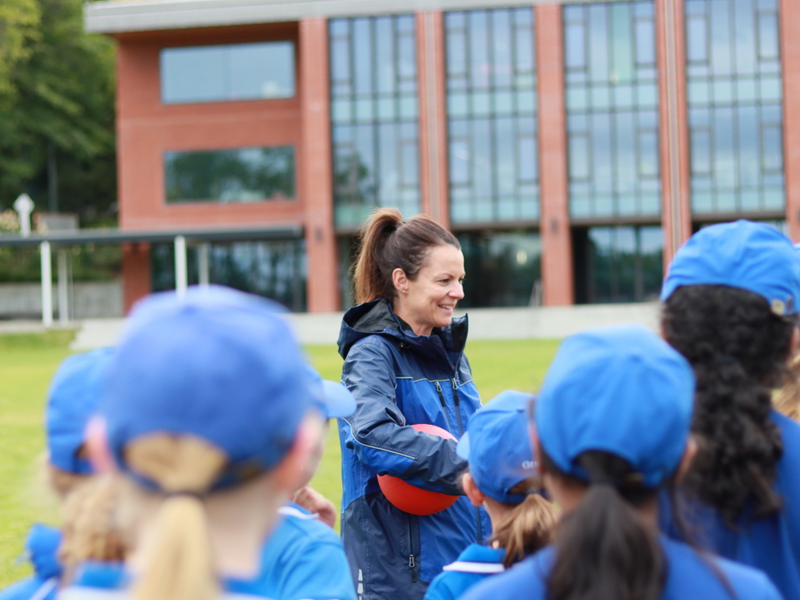

All Year levels had the privilege of welcoming ASB’s GetWise Educator, Callum into the school to help them to define their skills. The GetWise workshop is an interactive programme that aims to teach ‘good’ money habits to help set students up for the future. In this workshop, the students learned the fundamentals of money in four different stages, from identifying needs and wants, and learning to save and budget – giving them a solid foundation to build on.

The Year 5 and 6 students looked at ways in which they can earn pocket money. They spoke about working for their parents and doing chores around the house to make a ‘wage’ in which they could learn to save and spend their money. Callum reinforced the idea that the students divide up the money they earn into three jars – a spend jar, save jar and a share jar. This is to help them manage their spending.

For the Year 7 and 8 students, the focus was on a trip to ‘Fiji’ and learning about different types of insurance, needs, wants, expenses and maintaining a budget along the way. Callum provided a fun experience where the girls were split up into groups and given ‘$2,000’ to spend. On their journey to ‘Fiji’, they had to make many decisions such as whether to fly first class or economy, purchase health insurance, types of accommodation to stay in and car insurance. The girls encountered many unforeseen expenses along the way such as food poisoning and delayed flights. The team with the most amount of money at the end of the trip won.

When developing financial literacy skills, students are required to think on their feet and realistically about things they may not have considered before, overall preparing them for the future and possible decisions they may have to make. We thank Callum for his time and expertise!